Abstract

Government programs designed to provide income safety nets often restrict eligibility to families with children, creating an unintended fertility incentive. This paper considers whether dramatically changing incentives in the earned income tax credit affect fertility rates in the USA. We use birth certificate data spanning the period 1990 to 1999 to test whether expansions in the credit influenced birthrate among targeted families. While economic theory would predict a positive fertility effect of the program for many eligible women, our results indicate that expanding the credit produced only extremely small reductions in higher order fertility among white women.

Similar content being viewed by others

Notes

A qualified child is a natural or adopted child or stepchild of taxpayers filing joint or single head of household returns. In 1990, a parent had to provide more than half the support for the child regardless of whether he or she lived with the child. Beginning in 1991, a parent could claim the EITC only if the child lived with him or her for more than half the year. For a thorough introduction to the EITC program, its historical development and provisions, see Hoffman and Seidman (2002).

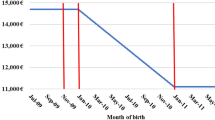

In 1991, 1992, and 1993, the EITC was greater for filing units with children under 1 year of age. This so-called “wee-tots” credit increased the maximum credit by $388 in 1993.

Beginning in 1998, Minnesota had a two-tiered system where there is a second flat range above the initial one.

We note that there is no evidence that the EITC causes a behavioral response on the internal margin of hours worked (see, for example, Eissa and Liebman 1996).

According to the National Center for Health Statistics, a nurse attending at the birth collects this information from both the mother and father (if present). Contacts at the NCHS have told us that they assume the mother herself to be the source of all information in the certificates, except in a small number of states that impute marital status.

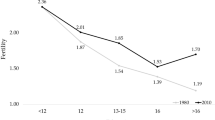

These results are consistent with other similar work. In the Current Population Survey, Eissa and Hoynes (2004) find that in tax year 1996, around 60% of married couples with children where the woman has less than a high school education are eligible for the EITC, and 19% of those where the woman has exactly a high school education are eligible. Using the cohort from the National Longitudinal Survey of Youth 1979 data, Dahl and Lochner (2005) find that 39% of mothers eligible for the EITC are high school dropouts, 48% have a high school degree, and 14% have some college.

The GAO (1996) estimated that 73% of married couples and only 53% of single parent receiving the EITC in 1994 were in the phase-out range.

Note that to be able to estimate populations for cell denominators using a 5% PUMS sample, we combine black and other non-whites into a single non-white category, and we combine 15- to 19- and 20- to 24-year-olds into a single category.

Ideally, women would be assigned to birth groups based upon total completed fertility. We use the number of children living in the household as a proxy for all children born to the mother because the 2000 Census did not ask a total fertility question.

Washington State did not record education on the birth certificate until 1992. In our 10-year sample, Washington and Connecticut average approximately 8 and 37% (respectively) of birth certificates missing information on mother’s education. In 1990, New York and New Jersey average approximately 41% of birth certificates missing data on mother’s education. In most cases, the missing data results because particular geographic regions within the state did not record mother’s education. We also exclude observations without a record of birth order. This is approximately 0.3% of all birth certificates in the nation. Connecticut accounts for a large share of these. We present specification tests that address the decision to drop these missing observations later in the paper.

The mean birthrate for all women in the dataset (including those with higher education) is 6.67 per 100 women, which compares well with national estimates ranging from 70.9 per 1,000 in 1990 to 65.9 per 1,000 in 1999 (US Census Bureau 2001).

As a falsification test, we separately estimate the regressions for samples of second births and third and higher order births. We use the EITC base and incremental values for second births as the primary independent variables for both samples. Because the EITC creates no incentive for third or higher order births, a significant effect would seemingly indicate a spurious relationship between the EITC incremental value variable and fertility. We do not find any convincing evidence of such a spurious relationship. While the coefficient on the second child incremental variable is still negative (−0.092) for third or higher order births, it is not statistically significant at standard levels and is smaller than the coefficient for second births only using the appropriate EITC values (−0.115). However, because neither coefficient is precisely estimated, we cannot reject equality between the two.

Dehejia and Lleras-Muney (2004) find that the health of babies is positively related to the unemployment rate and attribute at least some of this to the selection into motherhood during economic downturns.

In the cases where the EITC variables are zero, we put in 0.00001.

The following states inferred marital status, sometimes very badly, in the vital statistics data for some or all of the years in our data Michigan (all years), New York (all years), Connecticut (before 1998), California (before 1995), Nevada (before 1997), and Texas (before 1994) (US Department of Health and Human Services 2002; Ventura and Bachrach 2000).

It does not seem likely that there are differential labor supply responses between married and unmarried women in this case. An increase in the base EITC should provide incentive for married women to drop out of the labor force, given that most eligible married women are in the phase-out range of the EITC. This should be correlated with an increase in fertility rather than the increase that we see.

The welfare literature often restricts the sample to women with less than a high school diploma, but given the earnings requirements in the EITC, this restriction is not reasonable in our case.

For example, the estimated elasticity of −0.422 combined with a mean birthrate of 6.96 per 100 for higher order births to college-educated white women would imply more than a 2 percentage point reduction in the birthrate in response to the EITC.

References

Acs G (1996) The impact of welfare on young mothers’ subsequent childbearing decisions. J Hum Resour 31(4):898–915

Becker GS (1991) A treatise on the family. Enlarged edn., Harvard University Press, Cambridge

Bitler M, Zavodny M (2000) The effect of Medicaid eligibility expansions on births. Working Paper 2000–4. Federal Reserve Bank of Atlanta

Camasso MJ, Jagannathan R, Killingsworth M, Harvey C (2003) New Jersey’s family cap and family size decisions: findings from a five-year evaluation. In: Polachek SW (ed) Research in labor economics: worker well-being and public policy. Elsevier, Amsterdam, pp 71–112

Currie J, Gruber J (1996) Saving babies: the efficacy and cost of recent changes in the Medicaid eligibility of pregnant women. J Polit Econ 104(6):1263–1296

Dahl G, Lochner L (2005) The impact of family income on child achievement: evidence from the earned income tax credit. Working Paper, University of Rochester

Daponte BO, Wolfson LJ (2003) How many American children are poor? Considering census undercount by comparing census to administrative data. Working Paper, Carnegie Mellon University

Dehejia R, Lleras-Muney A (2005) Booms, busts and babies health. Q J Econ 119(3):1091–1130

Dickert S, Houser S, Scholz JK (1995) The earned income tax credit and transfer programs: a study of labor market and program participation. In: Poterba JM (ed) Tax policy and the economy, vol. 9. MIT Press, Cambridge, pp 1–50

Dickert-Conlin S, Chandra A (1999) Taxes and the timing of birth. J Polit Econ 107(1):161–177

Dickert-Conlin S, Houser S (2002) EITC and marriage. Natl Tax J 55(1):25–40

Dyer WT, Fairlie RW (2004) Do family caps reduce out-of-wedlock births? Evidence from Arkansas, Georgia, Indiana, New Jersey and Virginia. Popul Res Policy Rev 23(5–6):441–473

Duchovny NJ (2001) The earned income tax credit and fertility. Ph.D. dissertation, University of Maryland

Eissa N, Hoynes HW (2004) Taxes and the labor market participation of married couples: the earned income tax credit. J Public Econ 88(9–10):1931–1958

Eissa N, Liebman JB (1996) Labor supply response to the earned income tax credit. Q J Econ 111(2):605–637

Ellwood D (2000) The impact of the earned income tax credit and social policy reforms on work, marriage, and living arrangements. Natl Tax J 53(4) Part 2:1063–1105

Fairlie RW, London RA (1997) The effect of incremental benefit levels on births to AFDC recipients. J Policy Anal Manag 16(4):575–597

Feenberg DR, Coutts E (1993) An introduction to the TAXSIM model. J Policy Anal Manag 12(1):189–194

Fraser CD (2001) Income risk, the tax-benefit system and the demand for children. Economica 68:105–125

Gauthier AH, Hatzius J (1997) Family benefits and fertility: an econometric analysis. Popul Stud 51(3):295–306

Grogger J, Bronars SG (2001) The effect of welfare payments on marriage and fertility behavior of unwed mothers: results from a twins experiment. J Polit Econ 109(3):529–545

Hitsurana DP, Stinson TF (2004) Urban and rural differences in utilization of state earned income tax credit programs: Minnesota’s experience. RPRC Working Paper No. 04-08. Rural Poverty Research Center, Columbia MO and Corvallis OR

Hoffman SD, Seidman LS (2002) Helping working families: the earned income tax credit. W.E. Upjohn Institute, Kalamazoo, MI

Holtzblatt J, McCubbin J (2004) Issues affecting low-income filers. In: Aaron HJ, Slemrod J (eds) The crisis in tax administration. Brookings Institution Press, Washington, DC, pp 148–200

Horvath-Rose A, Peters HE (2002) Welfare waivers and non-marital childbearing. In: Duncan G, Chase-Landsdale L (eds) Welfare reform: for better, for worse. Russell Sage, New York, pp 222–244

Hotz VJ, Miller R (1988) An empirical analysis of life cycle fertility and female labor supply. Econometrica 56(1):91–118

Hotz VJ, Klerman JA, Willis RJ (1997) The economics of fertility in developed countries. In: Rosenzweig MR, Stark O (eds) The handbook of population and family economics. Elsevier, Amsterdam, pp 275–347

Hotz VJ, Mullin C, Scholz JK (2006) Examining the effect of the earned income tax credit on the labor market participation of families on welfare. NBER Working Paper 11968

Hoynes HW (1997) Does welfare play any role in female headship decisions? J Public Econ 65(2):89–117

Jagannathan R, Camasso MJ, Killingsworth M (2004) New Jersey’s family cap experiment: do fertility impacts differ by racial density? J Labor Econ 22(2):431–460

Joyce T, Kaestner R, Kwan F (1998) Is Medicaid pronatalist? The effect of eligibility expansions on abortions and births. Fam Plann Perspect 30(3):108–113

Joyce T, Kaestner R, Korenman S, Henshaw S (2004) Family cap provisions and changes in births and abortions. Popul Res Policy Rev 23(5-6):475–511

Kearney MS (2004) Is there an effect of incremental welfare benefits on fertility behavior? A look at the family cap. J Hum Resour 39(2):295–325

Kniesner TJ, Ziliak J (2002) Tax reform and automatic stabilization. Am Econ Rev 92(3):590–612

Levine PB (2002) The impact of social policy and economic activity throughout the fertility decision tree. NBER Working Paper 9021

Liebowitz A (1990) The response of births to changes in health care costs. J Hum Resour 25(4):697–711

Meyer BD, Rosenbaum DT (2000) Making single mothers work: recent tax and welfare policy and its effects. Natl Tax J 53(4):1027–1062

Milligan K (2005) Subsidizing the stork: new evidence on tax incentives and fertility. Rev Econ Stat 87(3):539–555

Moffitt RA (1998) The effect of welfare on marriage and fertility: what do we know and what do we need to know? In: Moffitt R (ed) Welfare, the family and reproductive behavior: research perspectives. National Academy of Sciences Press, Washington, DC, pp 50–96

National Center for Health Statistics. Various years. Technical appendix from Vital Statistics of the United States. www.cdc.gov/nchs/births.htm#methods

National Governors Association. Various years. Maternal and child health update

Neumark D, Wascher W (2001) Using the EITC to help poor families: new evidence and a comparison with the minimum wage. Natl Tax J 54(2):281–317

Scholz JK (1994) The earned income tax credit: participation, compliance and antipoverty effectiveness. Natl Tax J 47(1):63–87

Schulz TP (1973) A preliminary survey of economic analyses of fertility. Am Econ Rev 63(2):71–78

Slemrod J (1990) Do taxes matter? The impact of the Tax Reform Act of 1986. MIT Press, Cambridge

United States Census Bureau (2001) Statistical abstract of the United States, 121st edn. Government Printing Office, Washington, DC

United States Congress (2004) Green book. Government Printing Office, Washington, DC

United States Department of Health and Human Services (2002) Technical appendix from vital statistics of United States, 2000, Natality. Hyattsville, MD

United States General Accounting Office (1992) Earned income tax credit: advance payment option is not widely known or understood by the public. Washington DC: GAO/GGD-92-26, February

United States General Accounting Office (1996) Earned income tax credit: profile of tax year 1994 credit recipients. Washington DC: GAO/GGD-96-122BR

United States Government Accounting Office (2001) Earned income tax credit eligibility and participation. GAO-02-290R. Washington, DC

Ventry DJ (2000) The collision of tax and welfare politiroffsetcs: the political history of the earned income tax credit, 1969–1999. Natl Tax J 53(4):983–1026

Ventura SJ, Bachrach CA (2000) Nonmarital childbearing in the United States, 1940–99. Natl Vital Stat Reports 48(16):1–39

Willis R (1973) A new approach to the economic theory of fertility behavi.or. J Polit Econ 81(2):S14–S64

Whittington LA (1992) Taxes and the family: the impact of the tax exemption for dependents on marital fertility. Demography 29(2):215–226

Whittington LA, Alm J, Peters E (1990) Fertility and the personal exemption: implicit pronatalist policy in the United States. Am Econ Rev 80(3):545–556

Yelowitz AS (1994) The effect of Medicaid expansions on the behavior of the poor. Ph.D. dissertation, Department of Economics, Massachusetts Institute of Technology

Zhang J, Quan J, Van Meerbergen P (1994) The effect of tax-transfer policies on fertility in Canada, 1921–88. J Hum Resour 29(1):181–201

Acknowledgment

Thanks to Gabrielle Chapman, Cristian Meghea, and Karoline Mortenson for excellent research assistance. We are also grateful to Janet Holtzblatt, Saul Hoffman, Marianne Bitler, Elizabeth Peters, Irv Garfinkel, and anonymous referees for helpful comments and suggestions. Baughman gratefully acknowledges the support of the Robert Wood Johnson Scholars in Health Policy Research Program while the project was being completed. All remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Junsen Zhang

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Baughman, R., Dickert-Conlin, S. The earned income tax credit and fertility. J Popul Econ 22, 537–563 (2009). https://doi.org/10.1007/s00148-007-0177-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-007-0177-0